Advertisement

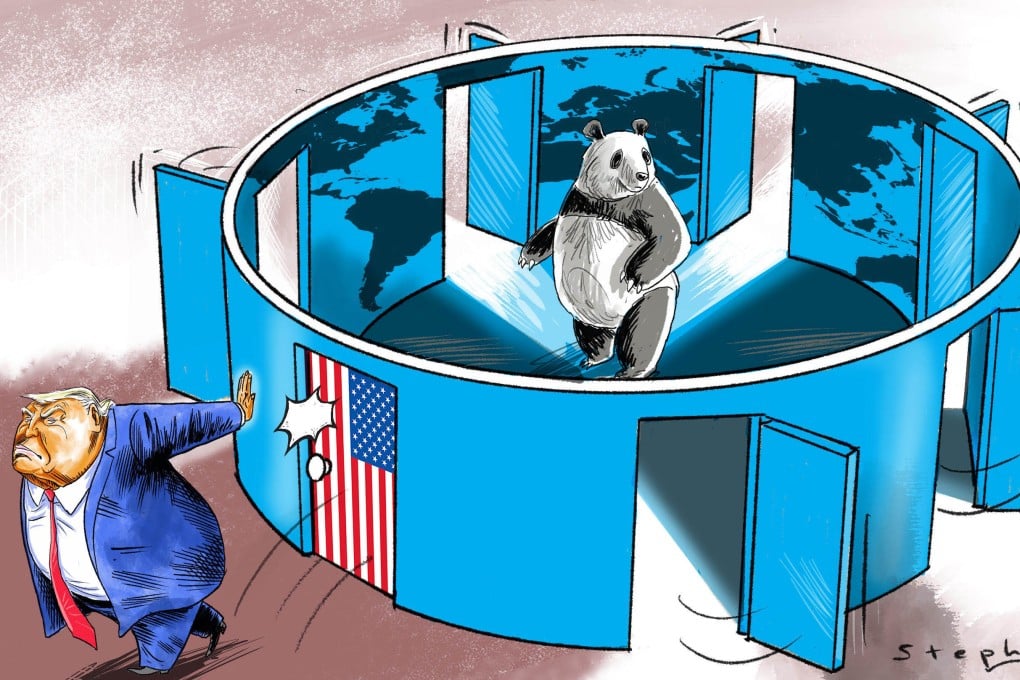

Opinion | Trump’s tariffs offer China an opportunity riding a dangerous wind

The US president’s moves could serve as a catalyst for China to increase domestic stimulus and forge closer ties with its major trading partners

Reading Time:3 minutes

Why you can trust SCMP

6

On Wednesday, US President Donald Trump declared “Liberation Day” for the United States by initiating a global trade war. For the rest of the world, it was a day marked by anger, frustration and regret.

China, deemed one of “the worst offenders” by Trump, was hit hardest at a time when its economy is struggling. The Ministry of Commerce promptly expressed opposition and vowed to implement countermeasures to safeguard China’s rights and interests.

However, Beijing should view Trump’s extreme measures as an opportunity. Although the tariffs deliver a short-term blow to China’s economy, these measures could serve as a catalyst for China to increase domestic stimulus and take decisive steps to forge closer trade and economic ties with its major trading partners who were also affected by the higher US tariffs.

In the “Liberation Day” announcement, Trump imposed a 34 per cent “reciprocal tariff” on Chinese goods in addition to the 20 per cent previously levied because of Beijing’s purported failure to curb the flow of raw materials for fentanyl to the US. Before Trump’s presidency, the average US tariff on China was 15 per cent; thus, the April 2 announcement raised the average tariff rate on Chinese goods to a staggering 69 per cent.

Furthermore, Trump ended the duty-free exemptions for China’s small parcel exports, which amounted to US$30-$50 billion annually. Consequently, China’s exports, a major driver of economic growth, are poised for a sharp decline.

Larry Hu, chief China economist at investment bank Macquarie, estimated that Trump’s latest tariffs could reduce China’s exports by 15 percentage points and its gross domestic product growth by 2-2.5 percentage points. “The impact could manifest itself through multiple channels such as falling US demand for Chinese goods, the potential global economic slowdown and the hit on export re-routing,” Hu wrote in a research report released on Thursday.

Advertisement